The Institute of Chartered Accountants of India (ICAI) has formulated the New Scheme of Education and Training in lines with International Education Standards and National Education Policy, 2020 (NEP) after considering the inputs from various stakeholders. The New Scheme of Education and Training has been notified in the Gazette of India on 22nd June, 2023 and will come into effect from 1st July, 2023.

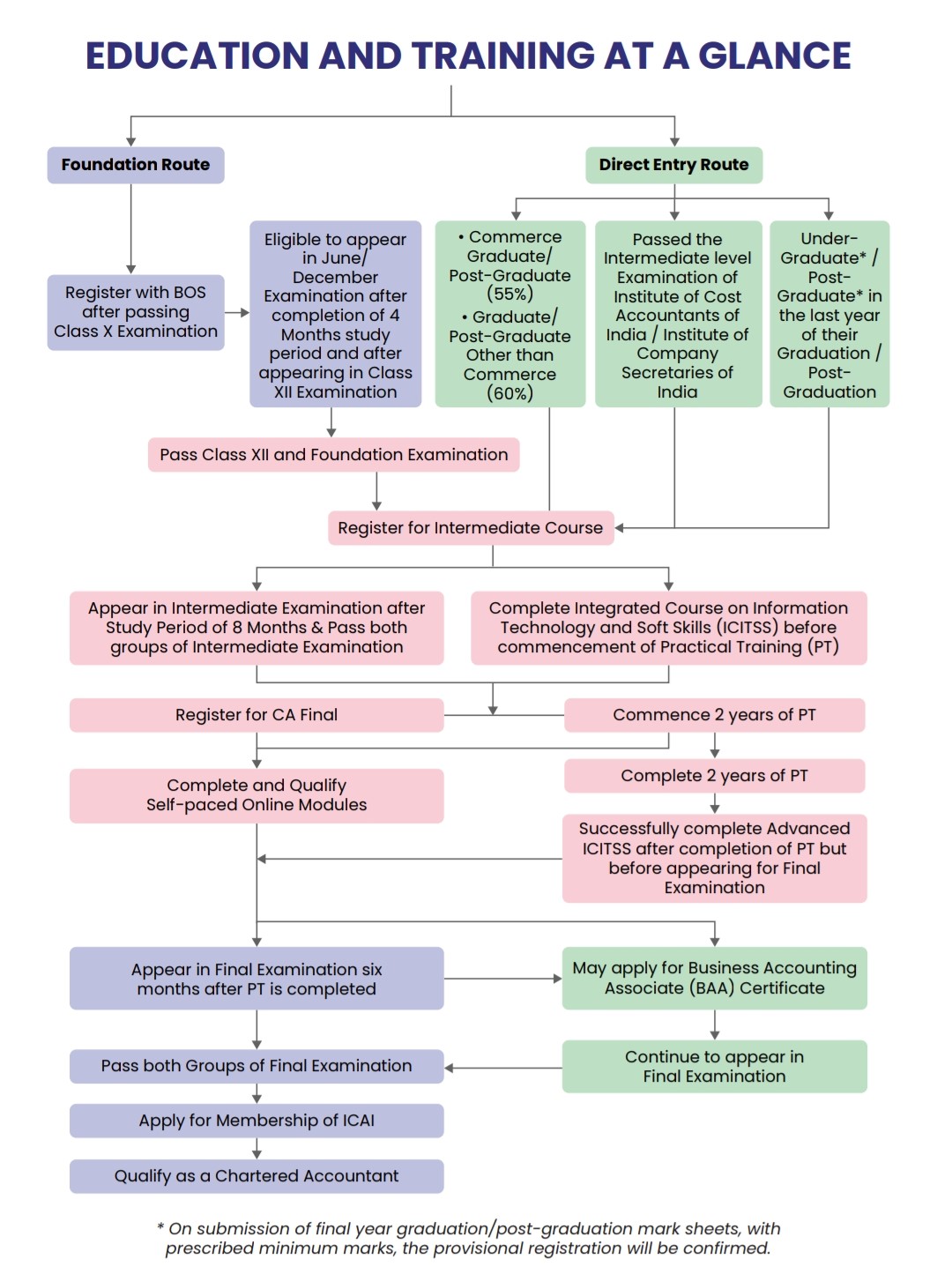

The New Scheme of Education and Training at a glance, is available below:

Important dates for the implementation of New Scheme of Education and Training are given as under:

| S.N. | Particulars | Date/ Attempt |

| 1. | Last date for Registration in Foundation under Existing Scheme | 1st July, 2023 |

| 2. | Last date for Registration in Intermediate and Final Courses under Existing Scheme | 30th June, 2023 |

| 3. | Date of commencement of Registration and Conversion in Foundation Course under New Scheme | 2nd August, 2023 |

| 4. | Date of commencement of Registration and Conversion in Intermediate and Final Courses under New Scheme | 1st July, 2023 |

| 5. | First Foundation Examination under New Scheme | June, 2024 |

| 6. | First Intermediate and Final Examination under New Scheme | May, 2024 |

| 7. | Last Foundation Examination under Existing Scheme | December, 2023 |

| 8. | Last Intermediate and Final Examination under Existing Scheme | November, 2023 |

| 9. | Last date of commencement of three years Practical Training | 30th June, 2023 |

| 10. | Date of commencement of two years uninterrupted Practical Training | 1st July, 2023 |

Important points to be noted:

- CA Intermediate and CA Final exams to be held in May, 2024 and onwards shall be held in new scheme.

- From July 1, 2023, all new registrations will be done in the New Scheme. Existing students will be converted to new scheme from same date.

- As subjects are reduced (from 8 to 6), there should not be much concern. New study material will be released by BOS, ICAI soon. Studying that for all subjects should be beneficial for the students because new questions as per the pattern suggested in the scheme may be asked from the material.

- For CA Final, self-paced modules should also be cleared by the students. Clearing those 4 self-paced modules will require time and efforts. Plan accordingly.

- Students currently undergoing 3 years training in existing scheme will continue the same and appear in CA Final during last 6 months of training only.

Note: Syllabus, Transition Scheme and Frequently Asked Questions (FAQs) will be hosted on 1st July, 2023. Paper wise exemption plan will be announced in due course.

(Also read: 10 tips for using your Credit Card smartly)

(Also read: 10 best investments for Tax Saving)

(Also read: Hotels or Restaurants cannot add Service charge automatically or by default in the Food bill)

(Also read: Government sets penalty upto Rs. 50 Lakhs for misleading advertisements and endorsements)

Disclaimer: The above post includes some content used from ICAI website and executed on this website for fair use only. As this website is of educational nature, hence the content is used for education and awareness to the public.

Title Tags: ICAI New Scheme of Education and Training to be Applicable from May 2024; ICAI Announces New Scheme of Education and Training, Students Must Plan Accordingly; ICAI New Course Approved by Central Government, Students Must Prepare for May 2024 Exams; ICAI New Scheme of Education and Training: What You Need to Know; ICAI New Course: Key Changes and Updates; ICAI New Scheme of Education and Training: Comparison with Old Scheme; ICAI New Course: Benefits for Students; ICAI New Course: How to Prepare; ICAI New Course: FAQs; ICAI New Course: Everything You Need to Know; ICAI New Scheme of Education and Training: A Game-Changer for CA Students; ICAI New Course: The Future of Accounting Education in India; ICAI New Scheme of Education and Training: A Step in the Right Direction; ICAI New Course: What Does it Mean for the CA Profession?; ICAI New Course: The Impact on the Job Market; ICAI New Course: What You Need to Do Now; ICAI New Course: The Start of a New Era for Cas; ICAI New Course: The Future is Now; ICAI New Course: The Way Forward; ICAI New Course: A New Beginning